vermont income tax rate 2020

Before the official 2022 California income tax rates are released provisional 2022 tax rates are based on Californias 2021 income tax brackets. Rates range from 335 to 875.

Here S How Much You Can Make And Still Pay 0 In Capital Gains Taxes

Vermont Income Tax Table Learn how marginal tax brackets work 2.

. BA-403 2020 Application for Extension of Time to File Vermont CorporateBusiness Income Tax Returns. 2020 Vermont Tax Deduction Amounts. We last updated Vermont Tax Rate Schedules in March 2022 from the Vermont Department of Taxes.

Find your income exemptions 2. Monday March 1 2021 - 1200. Personal Income Tax - 2020 VT Tax Tables.

2020 Vermont Tax Rate Schedules ExampleVT Taxable Income is 82000 Form IN-111 Line 7. Vermont Tax Brackets for Tax Year 2020 As you can see your Vermont income is taxed at different rates within the given tax brackets. 15 15 15 15.

Vermont also has a 600 percent to 85 percent corporate income tax rate. Residents of Vermont are also subject to federal income tax rates and must generally file a federal income tax return by April 15 2021. BA-404 2020 Instructions 2020 Tax Credits Earned Applied Expired And Carried Forward.

Filing Status is Married Filing Jointly. Tax rate of 76 on taxable income between 97801 and 204000. We will update this page with a new version of the form for 2023 as soon as it is made available by the Vermont government.

The rate notice provides you with your new unemployment tax rate. Pay Estimated Income Tax Online. 2019 VT Tax Tables.

5 5 5 5. Pay Estimated Income Tax by Voucher. Vermont has a graduated individual income tax with rates ranging from 335 percent to 875 percent.

These income tax brackets and rates apply to Vermont taxable income earned January 1 2020 through December 31 2020. Tax rate of 335 on the first 40350 of taxable income. Then your VT Tax is.

Vermont has a 600 percent state sales tax rate a max local sales tax rate of 100 percent and an average combined state and local sales tax rate of 624 percent. Tax rate of 66 on taxable income between 40351 and 97800. Subtract 75000 from 82000.

Vermont Income Tax Calculator How To Use This Calculator You can use our free Vermont income tax calculator to get a good estimate of what your tax liability will be come April. 7 sales tax Dover. Tax Year 2020 Personal Income Tax - VT Rate Schedules.

Tax Rate Filing Status Income Range Taxes Due 335 Single 0 to 40350 335 of Income MFS 0 to 33725. Vermonts income tax brackets were last changed two years prior to 2020 for tax year 2018 and the tax rates were previously changed in 2017. Ad Compare Your 2022 Tax Bracket vs.

2020 Vermont Tax Tables. Base Tax is 2758. 12 12 12 12.

The Vermont Married Filing Jointly filing status tax brackets are shown in the table below. Each marginal rate only applies to earnings within the applicable marginal tax bracket. Instructions 2020 Apportionment Allocation Schedule.

Tax Rates and Charts Mon 01112021 - 1200. There are -828 days left until Tax Day on April 16th 2020. The taxable wage figures are taken from the quarterly unemployment tax returns you and the benefits are from our submitted record of unemployment benefit claims paid out to your employees.

This means that these brackets applied to all income earned in 2019 and the tax return that uses these tax rates was due in April 2020. 7 sales tax Colchester. If you make 70000 a year living in the region of Vermont USA you will be taxed 12902.

8 8 8 8. An expansion of the Downtown Tax Credit Program from 24 million to 26 million. The table below shows rates and brackets for the four main filing statuses in Vermont.

Monday February 8 2021 - 1200. 18 18 18 18. Income Tax Brackets Single Filers Married Filing Jointly Married Filing Separately Head of Household.

Add this amount 462 to Base Tax 2758 for Vermont Tax of 3220. Vermont has four tax brackets for the 2020 tax year which is a change from previous years when there were five brackets. No Vermont cities have local income taxes.

7 sales tax Burlington. This form is for income earned in tax year 2021 with tax returns due in April 2022. The states top income tax rate of 875 is one of the highest in the nation.

RateSched-2020pdf 11722 KB File Format. Check the 2020 Vermont state tax rate and the rules to calculate state income tax 5. How to Calculate 2020 Vermont State Income Tax by Using State Income Tax Table 1.

Vermont Income Tax Return. Tax Rates Cigarette Tobacco Tax Rates Education Property Tax Rates Individual Tax Tables and Rate Schedules Local Option Tax Zip Codes Tax Charts 6 Vermont Sales Tax Schedule 9 Vermont Meals Rooms Tax Schedule Alcoholic Beverage Tax Local Option Alcoholic Beverage Tax Local Option Meals and Rooms Tax. More about the Vermont Tax Rate Schedules.

This column also applies to qualifying widower and civil union filing jointly status This column also applies to civil union filing separately status. Provided the state does not have any outstanding Title XII loans payment of state unemployment taxes in a timely manner reduces the federal unemployment tax rate from 60 to 6 so it is important to pay your state unemployment taxes on time. TaxTables-2020pdf 27684 KB File Format.

W-4VT Employees Withholding Allowance Certificate. Vermont has four marginal tax brackets ranging from 335 the lowest Vermont tax bracket to 875 the highest Vermont tax bracket. Multiply the result 7000 by 66.

Your average tax rate is 1198 and your marginal tax rate is. PA-1 Special Power of Attorney. 0 0 0 0.

7 sales tax Killington. Enter 3220 on Form IN-111 Line 8. The list below details the localities in Vermont with differing Sales Tax Rates click on the location to access a supporting Sales Tax Calculator.

Here is a list of current state tax rates. Any income over 204000 and 248350 for SingleMarried Filing Jointly would be taxes at the rate of 875. Your 2021 Tax Bracket To See Whats Been Adjusted.

The average family pays 83800 in Vermont income taxes. Find your pretax deductions including 401K flexible account contributions. The IRS will start accepting eFiled tax returns in January 2020 - you can start your online tax return today for free with TurboTax.

BA-405 2020 Economic Advancement Tax Incentives. Vermont has a progressive state income tax system with four brackets. Discover Helpful Information And Resources On Taxes From AARP.

Find your gross income 4. It is sent out annually in June and the rate is effective from July 1st until June 30th. For single taxpayers living and working in the state of Vermont.

In the end though there was a tax package that actually included some positive changes. An increase in the estate tax exclusion from 275 million to 425 million in January 2020 and 5 million in January 2021. Individuals Personal Income Tax.

Personal Income Tax - 2019 VT Rate Schedules. Tax rate of 875 on taxable income over 204000.

Tax Foundation On Twitter South Dakota Inbound Map

Per Capita Sales In Border Counties In Sales Tax Free New Hampshire Have Tripled Since The Late 1950s While Per Capita Sales In Big Sale Clothing Store Design

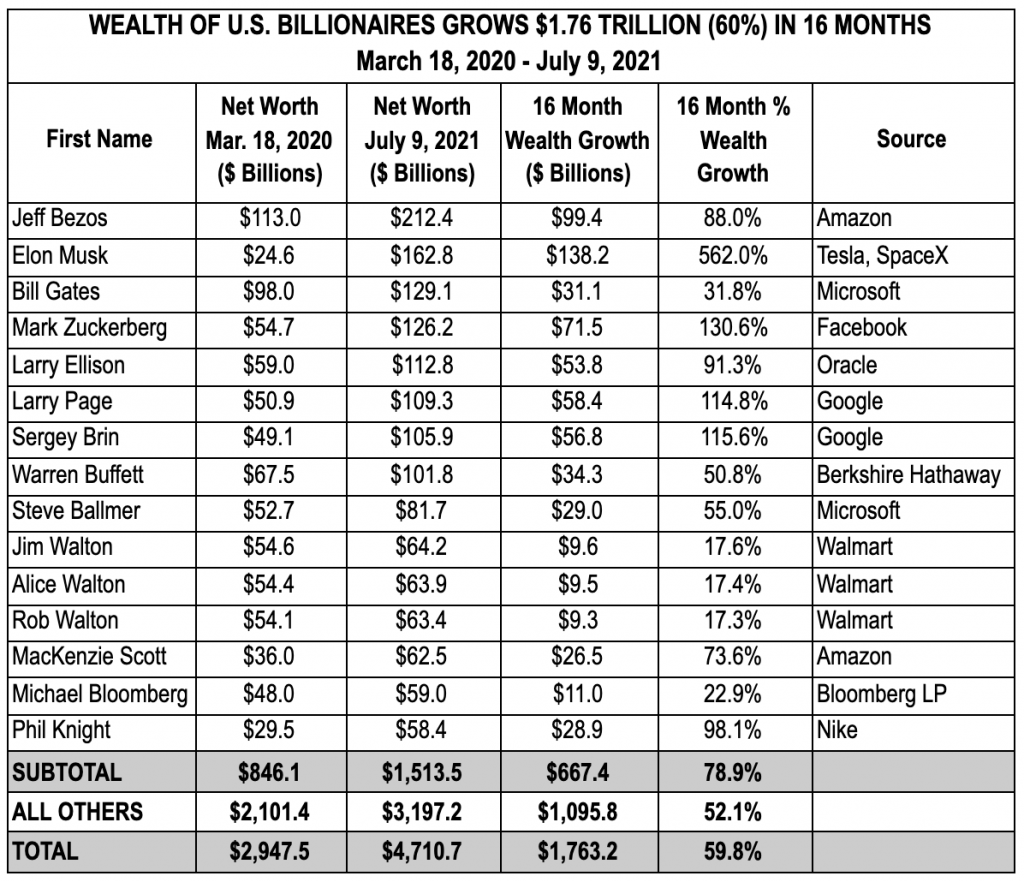

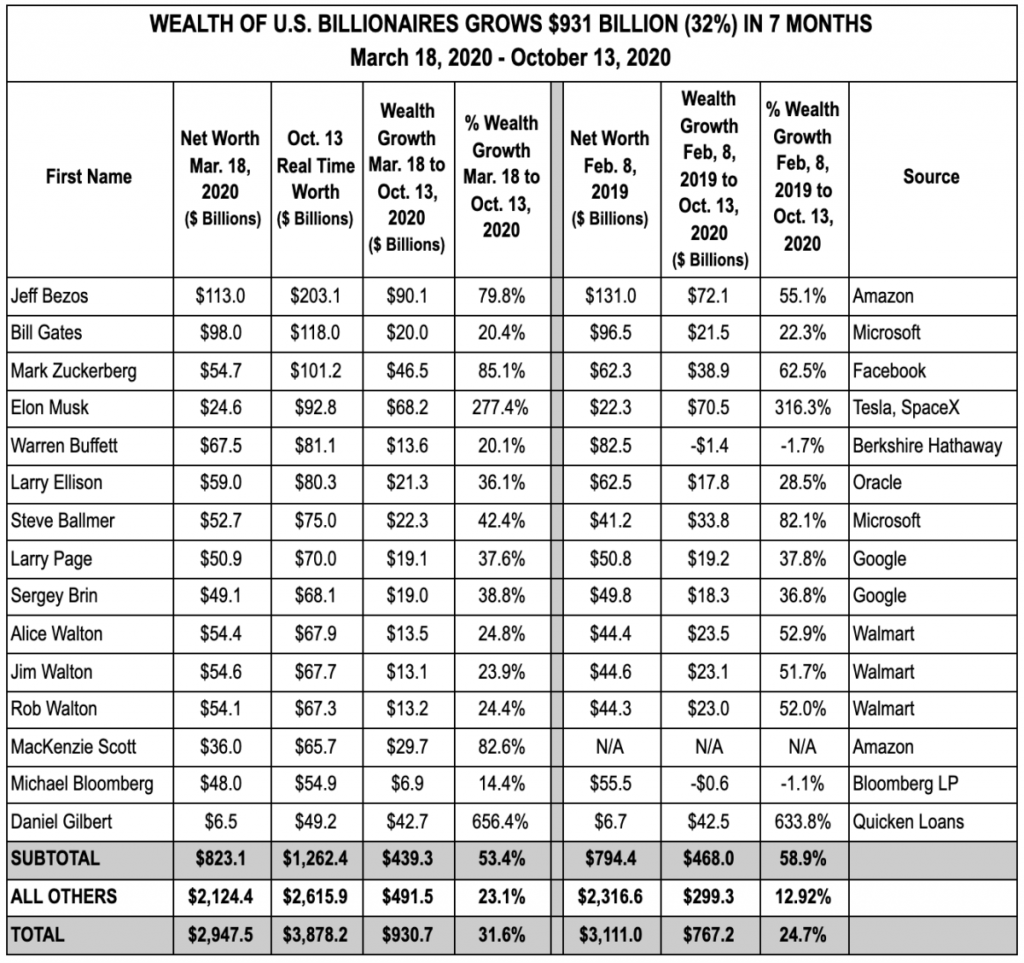

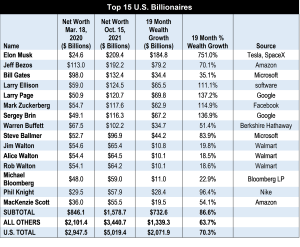

Updates Billionaire Wealth U S Job Losses And Pandemic Profiteers Inequality Org

Herbal Supplement Sales In Us Increase By Record Breaking 17 3 In 2020 American Botanical Council

Updates Billionaire Wealth U S Job Losses And Pandemic Profiteers Inequality Org

Irs Announces Higher Estate And Gift Tax Limits For 2020

Updates Billionaire Wealth U S Job Losses And Pandemic Profiteers Inequality Org

Updates Billionaire Wealth U S Job Losses And Pandemic Profiteers Inequality Org

State Income Tax Rates Highest Lowest 2021 Changes

Happy Patriots Day 2020 Patriots Day Boston Real Estate Boston Things To Do

Vermont Income Tax Calculator Smartasset

Vermont Income Tax Calculator Smartasset

Sample Payroll Tax Form 940 Payroll Taxes Tax Forms Payroll

Vermont Income Tax Brackets 2020